If money always feels just out of reach, no matter how hard you work, save, or plan, it’s probably not your budget that’s broken.

It’s your beliefs.

Most people don’t realize how many of their money struggles trace back to invisible myths they were handed. Quiet, inherited narratives from parents, society, religion, or past versions of themselves. Stories that sound like truth because they’re familiar, but are actually keeping them in cycles of scarcity and stress.

Let’s name those myths. Let’s dismantle them. And then, let’s talk about what to do instead, because shifting your relationship with money isn’t about spreadsheets. It’s about identity, nervous system safety, and building new emotional blueprints for wealth.

Myth 1: “You Have to Work Hard to Make Money”

This one runs deep. Grind culture. Hustle glorification. The idea that suffering equals success.

But let’s get honest: how many people do you know who work hard and still struggle? Meanwhile, others build wealth from aligned strategy, leveraged systems, and trust in their worth.

Truth: Money flows to clarity, alignment, and value, not just sweat.

Shift It: Ask, “Where am I over-efforting because I don’t feel safe trusting ease?”

🛠️ Action: Explore scalable or passive income ideas that feel true for you, courses, memberships, royalties, rentals, collaborations. Start planting seeds.

Myth 2: “Money Is the Root of All Evil”

You’ve heard it. Maybe even said it. This phrase was twisted from its original meaning, and now it’s weaponized against desire.

Truth: Money isn’t good or bad. It’s a mirror. It amplifies who you already are.

If you’re generous now, you’ll be more generous with more. If you’re scared of being “too much,” this belief will guilt you into staying small.

Shift It: “Money is a resource for expansion, healing, and possibility.”

🛠️ Action: Write down three beautiful things you’d do if you had more money. Let yourself feel that impact.

Myth 3: “I’m Just Not Good With Money”

This one keeps so many people stuck in avoidance. It turns shame into identity.

Truth: Money skills are learned, not inherited. You’re not bad at money. You’ve just never been shown a safe way to relate to it.

Shift It: “I can build trust with money over time.”

🛠️ Action: Start with one simple tool. Track your spending with curiosity, not judgment. Use cash envelopes, budgeting apps, or even a journal. Let it feel like empowerment.

Myth 4: “I Can’t Save Because I Don’t Make Enough”

It’s not about big numbers. It’s about emotional momentum.

Truth: Saving $5 when you’re broke is more powerful than saving $500 when you’re not. It rewires your identity.

Shift It: “I’m someone who honors my future self, even in small ways.”

🛠️ Action: Set an automatic transfer, $5, $10, whatever. Let consistency do the heavy lifting.

Myth 5: “All Debt Is Bad”

Debt isn’t inherently dangerous. It’s neutral. The difference is how it’s used and how your nervous system holds it.

Truth: Some debt is toxic (high-interest survival spending). Some is strategic (investing in growth, education, or wealth tools).

Shift It: “Debt can be a temporary bridge, not a sentence.”

🛠️ Action: Separate your debt into draining and expanding categories. Start creating a plan to minimize the former and leverage the latter.

Myth 6: “Rich People Are Greedy”

If your subconscious associates wealth with harm, it will block you from becoming someone who holds wealth.

Truth: Wealth reveals character, it doesn’t create it. The more aligned, ethical people have money, the more we can reshape the system from within.

Shift It: “I trust myself to hold wealth with integrity.”

🛠️ Action: Look for expanders, people you admire who use money for good. Let them rewrite the association.

Myth 7: “I’ll Handle My Money When I Have More”

This mindset delays wealth and anchors scarcity.

Truth: The way you treat your money now is shaping the version of you who’ll receive more. If you avoid it now, you’ll likely avoid it later, just with more zeros.

Shift It: “I’m building wealth from who I am now, not who I hope to be someday.”

🛠️ Action: Do a 30-day money awareness challenge. Not to restrict but to connect. Where does your money already support you? What feels out of sync?

Your Nervous System and Money, The Missing Link

If your body is wired to expect chaos, lack, or instability, you’ll keep creating those patterns. Not because you’re broken, but because they feel safe.

💡 Related: Why Your Nervous System is the Missing Link in Manifestation

Financial wholeness isn’t just a strategy. It’s regulation. It’s safety. It’s embodiment.

Start Rewriting Your Money Identity

Here’s what actually shifts money from struggle to flow:

- Safe, slow rewiring of your emotional blueprint

- Nervous system capacity to receive and hold more

- Identity anchored in trust, not survival

- Habits that reflect your future, not your past

You don’t need to master money. You just need to stop hiding from it. One brave choice at a time.

You’re Not Meant to Stay Small

These myths were handed to you by people who were scared, disconnected, or surviving.

You don’t have to carry them anymore.

You can create a new money story, one built on clarity, possibility, and emotional truth. And you don’t need to do it all today. You just need to start.

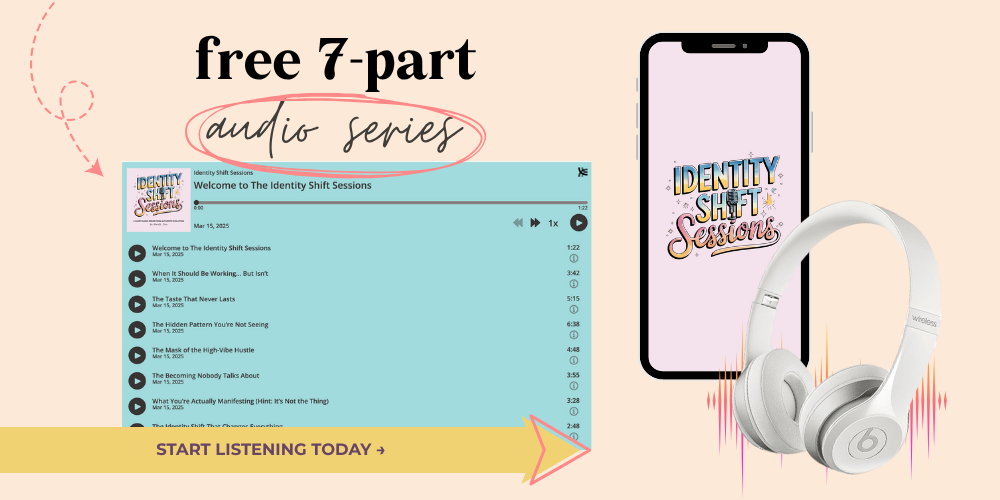

🎧 Want to Become the Version of You Who Feels Safe With More?

Start with The Identity Shift Sessions: a 7-part audio series designed to help you stop chasing and start embodying. If you’re done trying to think your way into abundance and ready to feel it from within…